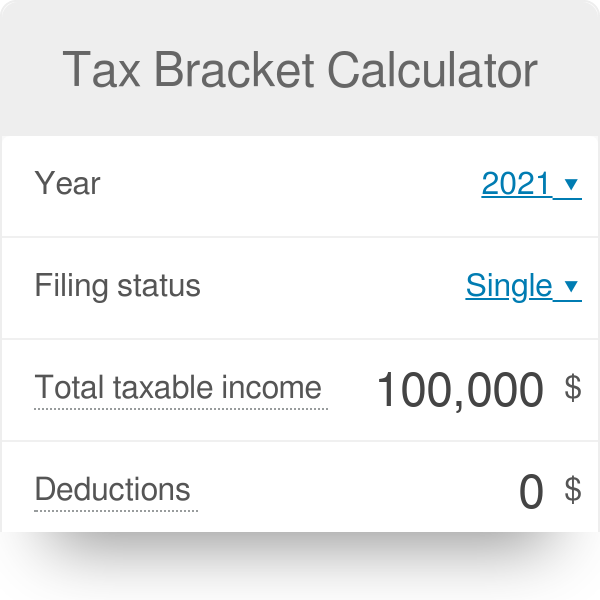

Tax bracket calculator 2021

2019 Tax Bracket for Estate. Use our Tax Bracket Calculator to answer What tax bracket am I in for your 2020-2021 federal income taxes.

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

After 11302022 TurboTax Live Full Service customers will be able to amend their 2021 tax return themselves using the Easy Online Amend process described above.

. This page provides detail of the Federal Tax Tables for 2021 has links to historic Federal Tax Tables which are used within the 2021 Federal Tax Calculator and has supporting links to each set of state. The above calculator provides for interest calculation as per Income-tax Act. Province of residence Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Quebec.

Between 13601 and 51800 your tax bracket is 12. 2021 Income Tax Calculator Income Tax Calculator. Theyre taxed at lower rates than short-term capital gains.

Youll get a rough estimate of how much youll get back or what youll owe. The income brackets though are adjusted slightly for inflation. Form 540 and 540 NR.

2021 FICA tax calculator is the easiest and fastest to know the social security tax and Medicare tax liability and also compute the additional medicare tax. Here are the tax brackets for tax years 2021 and 2022 and how you can work out which tax bracket you fit into. This calculator helps you estimate your average tax rate your tax bracket and your marginal tax rate for the current tax year.

For 2021 you can contribute up to 19500 to a 401k plan. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year 2022 due April 15 2023.

Based on your annual taxable income and filing status your tax bracket determines your federal tax rate. The 2022 state personal income tax brackets are updated from the New York and Tax Foundation data. See this Tax Calculator for more.

Your household income location filing status and number of personal exemptions. Tax Refund Calculator. The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 filing in 2023and 2021As you know everything you own as personal or investments- like your home land or household furnishings shares stocks or bonds- will fall under the term capital asset.

Long-term capital gains are gains on assets you hold for more than one year. This simple income tax calculator will instantly tell you how much tax you need to pay based on your income for the 202122 financial year. Tax calculator is for 2021 tax year only.

Use our simple 2021 income tax calculator for an idea of what your return will look like this year. Theyre taxed like regular income. See chart at left.

Tax Bracket Federal. Knowing your tax bracket can help you make smarter financial decisions. Checkout following Link for GConnect Income Tax Calculator 2021-22 AY 2022-23.

Single Taxable Income Over. Internal Revenue Code Simplified A Tax Guide That Saves You Money. The Texas income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022.

File your taxes the way you want. How Income Taxes Are Calculated. Do not use the calculator for 540 2EZ or prior tax years.

You can use our free Texas income tax calculator to get a good estimate of what your tax liability will be come April. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low. Between 82501 and 157500 your tax bracket is 24.

That means you pay the same tax rates you pay on federal income tax. 11 - Contents Contents. Province of residence Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Quebec Saskatchewan Yukon.

2021 Tax Brackets. Between 157501 and 200000 your tax bracket is 32. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

You can use our free California income tax calculator to get a good estimate of what your tax liability will be come April. Simply provide your filing status and taxable income to estimate your tax bracket. Before the official 2022 New York income tax rates are released provisional 2022 tax rates are based on New Yorks 2021 income tax brackets.

On the next page you will be able to add more details like itemized deductions. Tax Changes for 2021 - 2022 - 2020 rates have been extended for everyone. BAC disallows many income tax exemptions deductions it may still be beneficial to salaried employees who need to pay tax in higher tax bracket viz 30 for considerable quantum of their taxable income and do not claim major income tax exemptions.

It is determined by your taxable income and filing status. You remain in the 12 tax bracket while saving for retirement. Income tax brackets for the 2021 tax year tax returns filed in 2022 are as follows.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Get more with these free tax calculators. However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for payment from 20-03-2020 to 29-06-2020 shall attract interest at the lower rate of 075 for every month or part thereof if same is paid after the due date but on or before 30-06-2020.

If youre age 50 or above. But as a percentage of your income your tax rate is generally less than that. View federal tax rate schedules and get resources to learn more about how tax brackets work.

Income Tax Calculator Ontario 2021 Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Between 51801 and 82500 your tax bracket is 22. 2022 Income Tax Brackets Taxes Due April 2023 Or October.

The federal income tax rates remain unchanged for the 2021 and 2022 tax years. MarriedRDP Filing Jointly or Qualifying Widower Joint. Find out your tax refund or taxes owed plus federal and provincial tax rates.

If you need help determining your tax bracket visit TurboTaxs Tax Bracket Calculator. New York tax forms are sourced from the New York income tax forms page and are updated on a yearly basis. Tax Bracket Single Tax Bracket Couple Marginal Tax Rate.

Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Between 200001 to 500000 your tax bracket is 35. Your tax bracket is the rate you pay on the last dollar you earn.

Estimate your refund with TaxCaster the free tax calculator that stays up to date on the latest tax laws. Over 500001 your tax bracket is 37. TurboTax free Canada income tax calculator for 2021 quickly estimates your federal and provincial taxes.

10 12 22 24 32 35 and 37. This calculator shows marginal rates for the. Income Tax Calculator British Columbia 2021 Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

2022 Marginal Tax Rates Calculator. On the next page you will be able to add more details like itemized deductions tax credits capital gains and more. Newfoundland and Labrador tax bracket Newfoundland and Labrador tax rates Prince Edward Island tax bracket Prince Edward Island tax rates.

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

Inkwiry Federal Income Tax Brackets

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

Click Here To View The Tax Calculations Income Tax Income Online Taxes

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Tax Calculator Estimate Your Income Tax For 2022 Free

Excel Formula Income Tax Bracket Calculation Exceljet

Tax Calculator Refund Return Estimator 2021 2022 Turbotax Official

With Tax Day Right Around The Corner Here Are Eight Things To Keep In Mind As You Prepare To File Your 2020 Tax Income Tax Preparation Filing Taxes Income Tax

New Tax Regime Income Tax Slab For Ay 2021 22 For Individual Income Tax Income Tax

Sales Tax Calculator

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Tax Bracket Calculator

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax